APPLICATION + ENHANCEMENT

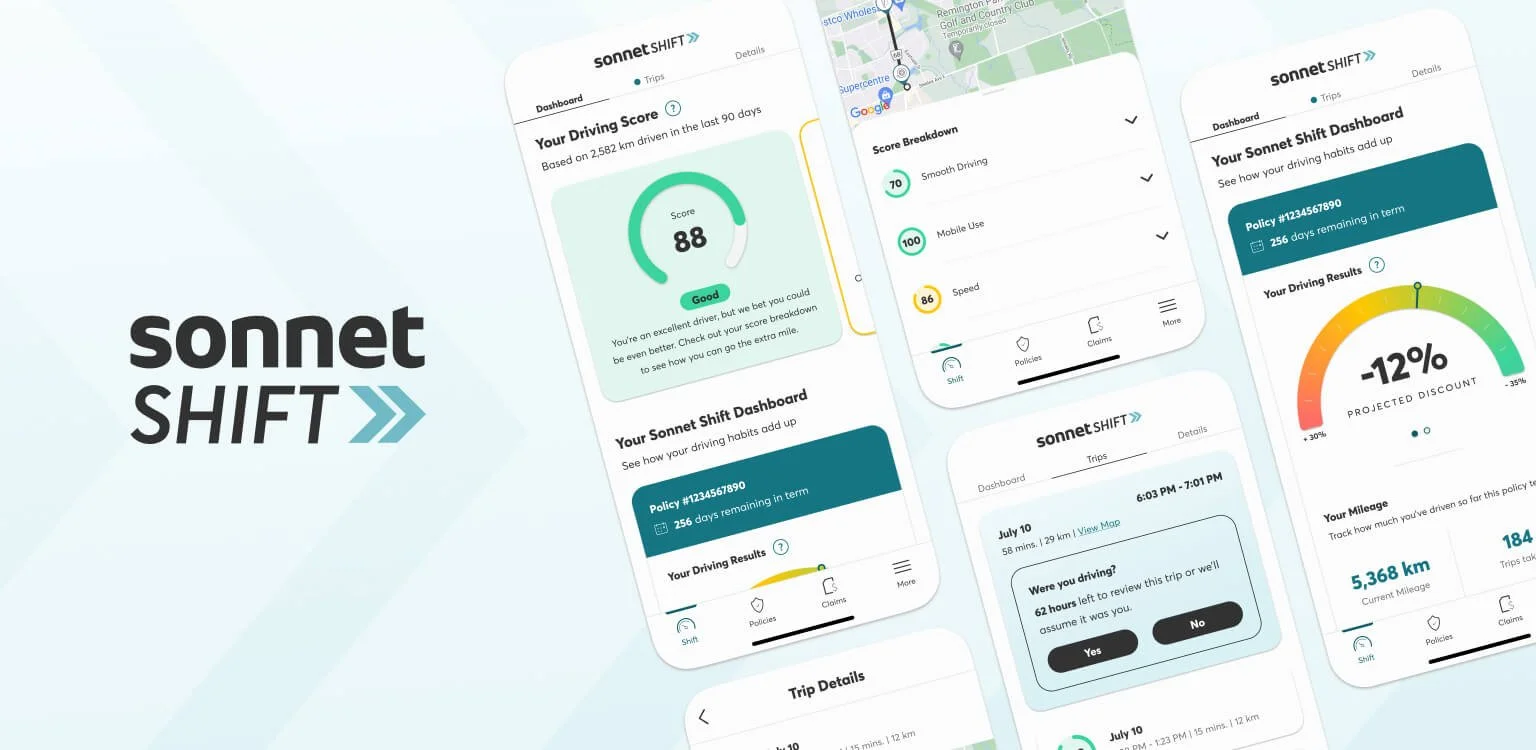

Reimagining car insurance: Launching Sonnet Shift

New type of insurance

In September 2023, Sonnet Insurance launched Sonnet Shift to meet the rising demand for usage-based insurance (UBI). This marks a significant change from the traditional insurance model. The new product uses a data-driven approach to auto insurance in which premiums depend on individual driving habits. However, this poses a challenge. Most customers are unfamiliar with how UBI functions or its requirements. To tackle this, the team aimed to simplify the experience and educate users along the way. We added personalized driving insights and clear, easy to understand tooltips to help customers understands their driving behaviour and its impact on their premiums.

Team

Designer 🙋🏻♀️, copy writer, UX research, data analysts, product owners, developers, underwriting team.

My role

Sole designer: design, UX technical requirements, QA and support through launch.

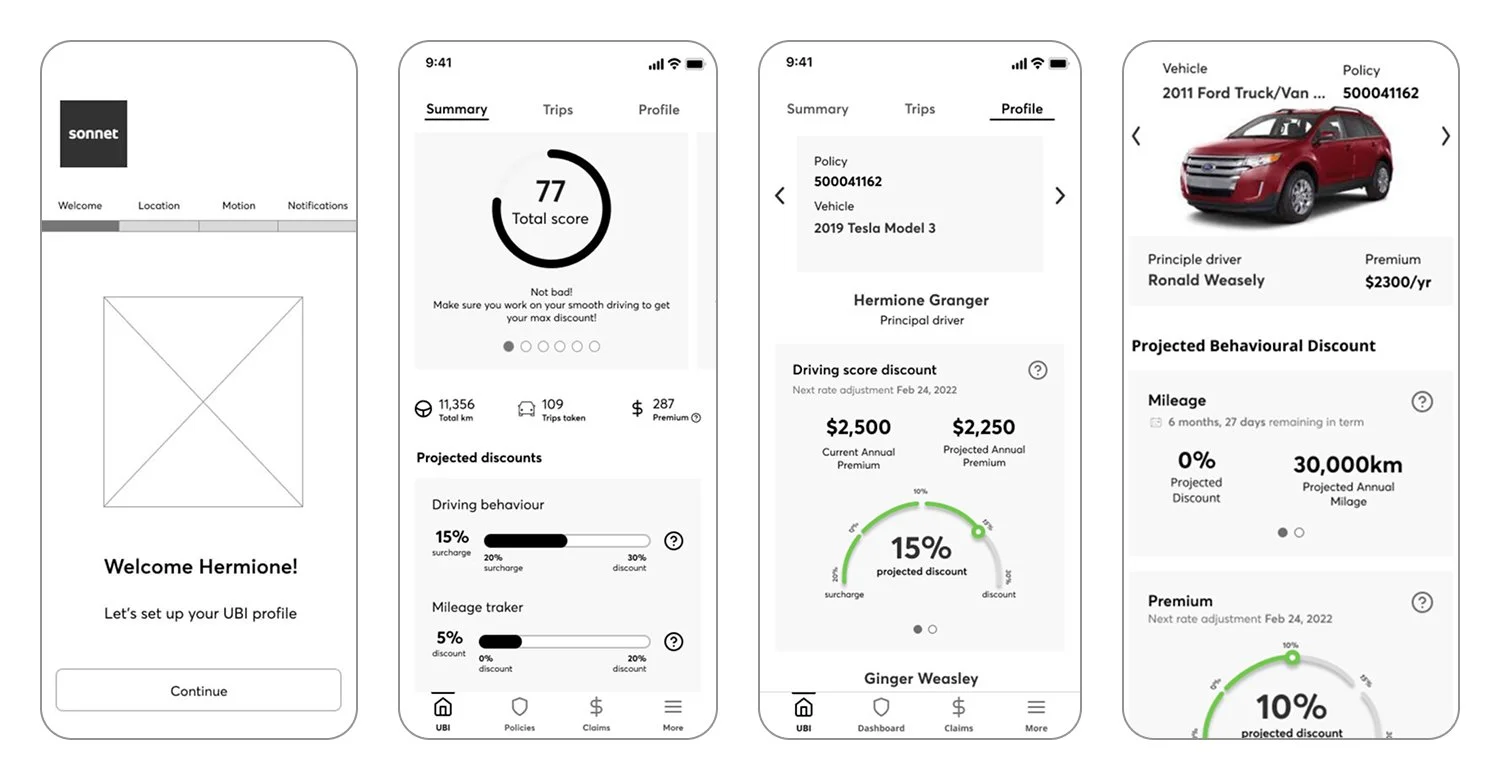

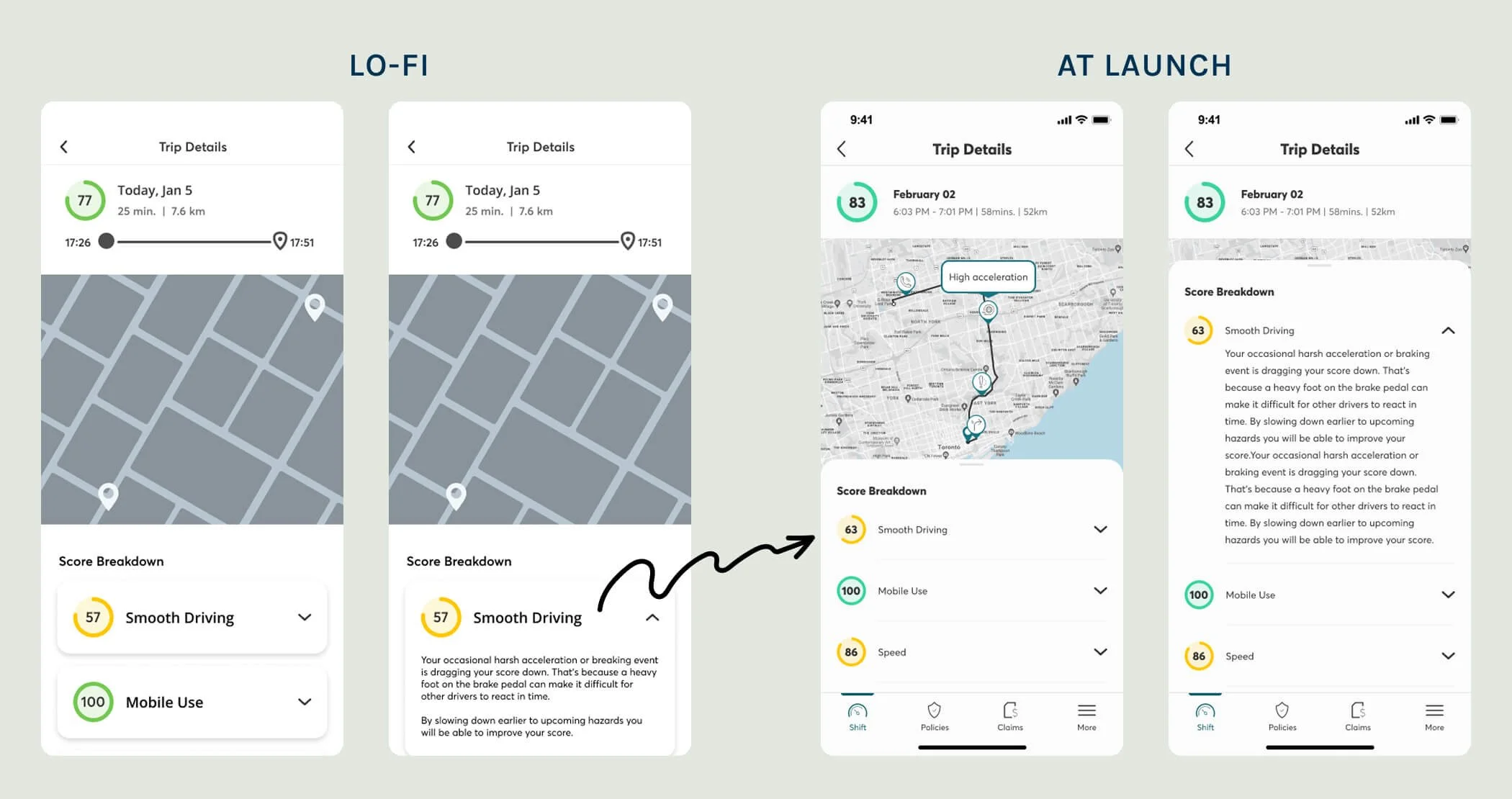

Taking ownership of Sonnet Shift

I collaborated with various teams for over a year to help bring Sonnet Shift to life. I turned complex product requirements into clear, user-friendly experiences. The Shift project included multiple workstreams. The marketing team focused on how to promote the new product. Another team worked on introducing and educating users about Shift within the quote flow. I led the design of the Shift landing page, working closely with a copywriter. Although I had no prior experience designing mobile apps, I took on the role when the original app designer left early in the project. I quickly ramped up, learning as much as I can and as fast as I can while taking full ownership of the Sonnet app experience. I led the design, iteration, and improvement of the entire app journey, from driving score breakdowns to trip insights. My focus was to make the app feel intuitive, while ensuring that it meets the underwriting requirements.

The stage the project was in when I took over:

Learning on the fly: Project challenges

🧠 Translating technical requirements into user-friendly experiences

Collaborating with the underwriting team presented a unique challenge. Their requirements often included jargons and unfamiliar UX behaviours that didn’t align with user expectations. I worked closely with them to bridge this gap, advocating for familiar interactions without compromising compliance.

⏲️ Designing under tight timelines

The aggressive timeline limited how much we could push on usability improvements. I proposed features like batch trip management (accept/decline multiple trips at once) and vacation mode to offer more control and flexibility, but these were deprioritized for launch. While not all ideas made it into the MVP, the experience was built with scalability and future iteration in mind.

💭 First-time mobile app design and platform differences

This was my first time designing for a mobile app, and my understanding of app development, especially platform specific behaviour was limited in the beginning. Although I did as much research as possible, I quickly learned that iOS and Android often required different design considerations. Some interactions didn’t translate well across both platforms, forcing us to explore separate solutions. We aimed to rely on native behaviours wherever we could. I also prioritized building strong relationships with two go-to developers (one for each OS) who I could regularly consult to mitigate risk and validate feasibility.

Challenges → launch

Over the course of a year, I worked closely with our content writer to finish the app. We went through many rounds of ideas that were rejected, reworked, or discarded. This project was heavily driven by the Underwriting team, leaving little room for design and content to take the lead. This often felt restricting. However, these challenges pushed me to be creative within the limitations. Despite it all, we pushed through and launched successfully. We met all requirements while still providing a cohesive and thoughtfully designed experience.

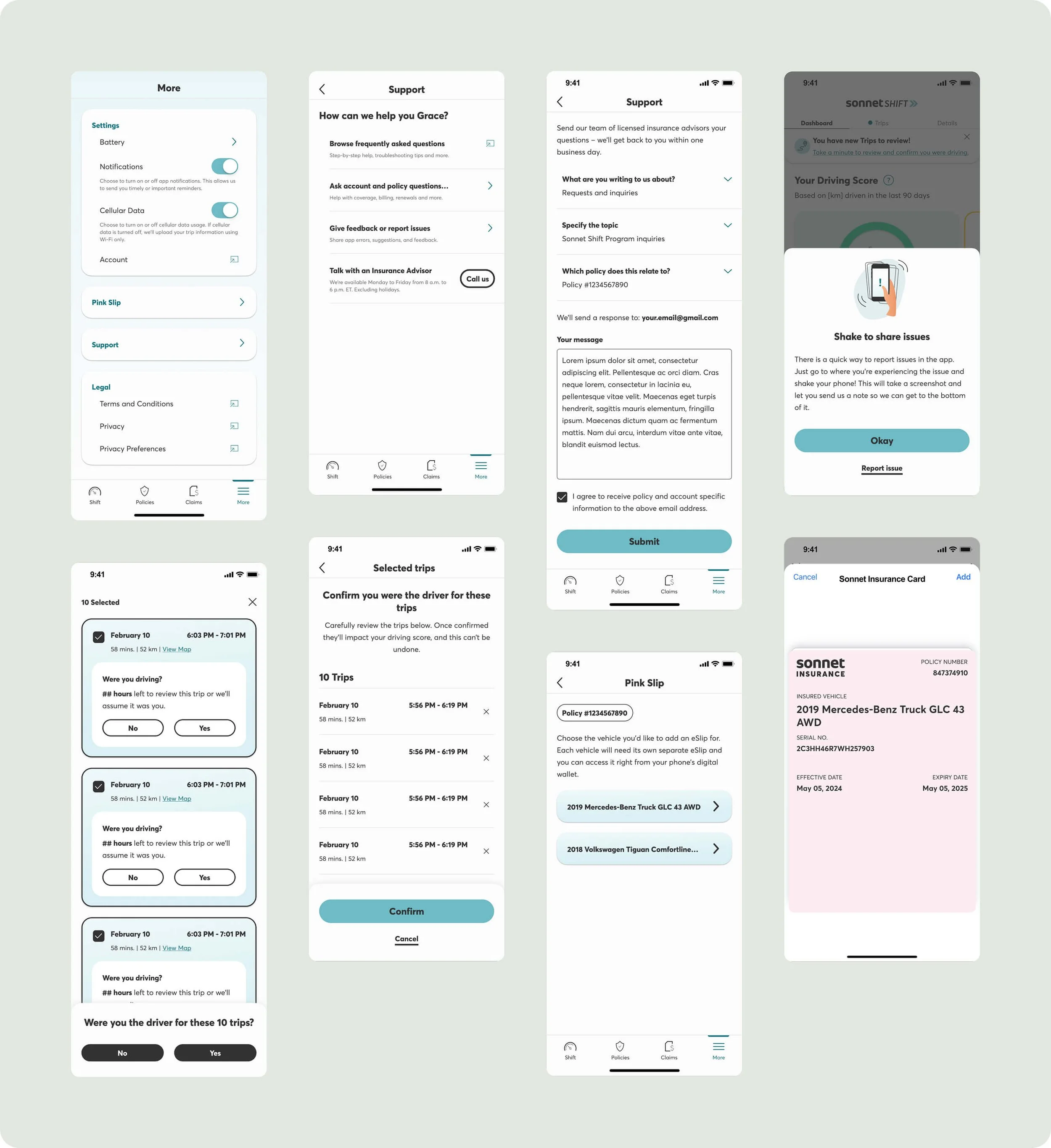

Post-launch app iteration & enhancements

Prior to launching Sonnet Shift, the team recruited approximately 30 internal staff members to test both the product and the app. While this provided valuable insights, launching this to the public was essential to validate interest and discover customer pain points. As with any MVP, some features needed to be deprioritized to meet deadlines. However, we've kept refining the product based on feedback and data. Since the launch, I’ve worked closely with the product owners, underwriting team and customer support team to improve the app experience and address known issues. One of our early improvements was adding a feedback feature in the app. This lets users report technical problems, ask policy-related questions, and connect directly with Insurance Advisors.

Enhancements I lead:

Digital e-slips (What is an e-slip?)

Enabled all auto policy customers to download and access their proof of insurance directly in the appSupport section in the app

Designed and launched in-app support hub, including:Frequently Asked Questions (FAQs)

A contact form for account and policy inquiries

An option to give app feedback or report issues

A ‘Call Us’ button for immediate help from an advisor

Enhancements I oversaw:

While not directly responsible for the design, I provided guidance and feedback for the following initiatives:

Batch trip management — Users can now accept or decline multiple trips at once

App rating prompt — A native pop-up to encourage App Store reviews

Tooltip feedback — “Was this helpful?” microinteractions to gather data and learning

Wait, what did I just buy? Fixing user confusion around Shift in the quote flow

Less than a year after launch, the Business Insights team ran a consumer research study to understand how customers were interacting with Sonnet Shift, and why some weren’t sticking with it. Some questions we needed answers to:

How can we boost adoption of the Shift app after policy purchase?

What’s stopping customers from activating their policy?

Why are some users switching back to Traditional, and how does that affect retention?

How do users feel about the app overall and how can we improve it?

What we found

UBI is still unfamiliar territory

Most drivers in Ontario aren’t familiar with usage-based insurance. Only 34% had even heard the term. Of those who had:74% thought it was only about how much you drive

Only 5% understood that it involved tracking driving behaviour

Many assumed it could save them money but didn’t realize it could also lead to a higher premium

Privacy and tracking concerns are a major barrier

When asked why they didn’t want to enroll:Many said they didn’t feel comfortable being tracked

Others were unsure how their data would be used or protected

Some didn’t want to stress about their driving affecting their premium

Most users don’t fully understand what they’re signing up for

23% of customers who purchased Shift didn’t realize they needed an app

During the quote flow, 60–70% of users didn’t read the information provided about Shift

65% thought UBI only related to mileage

30% couldn’t recall choosing Shift over Traditional in the quote flow

3 out of 10 customers didn’t understand how Shift worked when they purchased it

Key areas where users need to be educated on:

That premiums can go up or down, depending on driving behaviour

That they must activate their Shift policy or it defaults to Traditional

That pricing is updated quarterly, not annually like most insurance

What users don’t understand about Shift

Ultimately, the research showed that many users were selecting Shift because of the lower upfront price but weren’t aware of the program’s requirements or how it worked. This led to confusion and lack of app activation.

Problems we need to solve:

Users don’t realize they’re signing up for Sonnet Shift

Users don’t know Shift requires an app to stay enrolled

Users aren’t aware that the premium is dynamic and may increase

To address this, I partnered with a content writer to overhaul the quote flow experience to help users make informed decisions. Our focus was on clarity, transparency, and to reduce cognitive load. The original Package Select page at launch:

The UI above was worked on by another designer

What we did:

Reworked the content layout to guide users through the information more naturally

Simplified explanations of Shift using visual cues and bite-sized content

Removed the terms ‘Shift’ and ‘Traditional’ and replaced them with clearer, more user-friendly language

Made the difference between Shift and Traditional more obvious through clearer comparisons

Moved the prices to the bottom of each card to reduce bias toward the cheaper option and encourage users to read and understand the differences before selecting

Highlighted the app requirement earlier and more prominently and repeating it throughout the flow to ensure users saw it multiple times before purchasing

Introduced a learning modal after Shift selection to clearly communicate requirements (app, tracking, device, scoring) before user lands on the coverage selection page

Post-launch wins 🥳

The updated quote flow led to meaningful improvements in user understanding and behavior:

App activation increased by 5 points in Ontario and 9 points in Quebec within the first two weeks

Reached our 90% activation goal within 30 days

The split between product selections shifted from 50/50 (Traditional vs. Shift) to 70/30, with more users intentionally choosing Traditional. While Shift purchases went down, this shows better user understanding. Customers now select the product that best meets their needs. This leads to fewer cancellations and switches after purchase